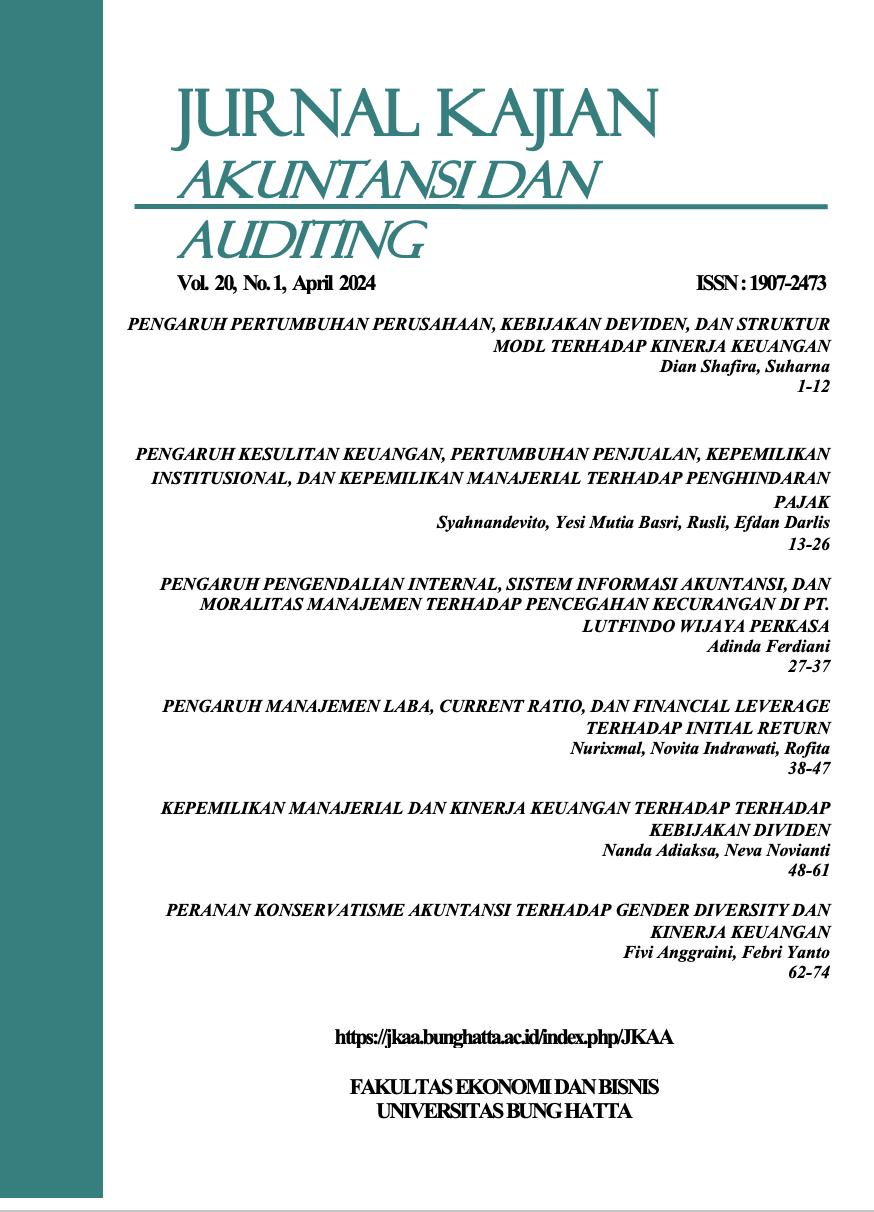

PENGARUH MANAJEMEN LABA, CURRENT RATIO, DAN FINANCIAL LEVERAGE TERHADAP INITIAL RETURN

DOI:

https://doi.org/10.37301/jkaa.v20i1.127Keywords:

Financial Leverage, Current Ratio, Initial Return, Earnings ManagementAbstract

This research intends to examine how influencing factors including earnings management, current ratio, and financial leverage influence IPO returns. Financial leverage is monitored by the DER ratio, while earnings management is evaluated using the distributive accrual modified Jones method. Companies listing on the Indonesia Stock Exchange as part of an initial public offering (IPO) between 2016 and 2019 make up the population. 153 businesses were selected at random from the pool of potential respondents using a purposive sampling method. Multiple linear regression is the method of analysis used here. According to the findings of this research, the current ratio and financial leverage affect initial return whereas earnings management does not

References

Adam, Mohamad, Samardi W Bakar dan Anisa Minarni. 2015. Analysis of Factors Affecting Underpricing Stock in Initial Public Offering in Indonesia Stock Exchange. International Journal of Research in Commerce & Management Vol. 6 ISSN: 0976-2183

Allen, Franklin dan Gerald R. Faulhaber. 1989. Signaling by Underpricing in The IPO Market. Journal of Financial Economics Vol. 23:303-323

Altensy, Mica. 2015. Pengaruh Informasi Keuangan, Non Keuangan dan Ekonomi Makro terhadap Underpricing pada Perusahaan yang Melakukan Initial Public Offering (IPO) Periode 2011-2013 di Bursa Efek Indonesia. Skripsi Fakultas Ekonomi dan Bisnis Universitas Riau.

Apriliyani, V. E., Fuad, H., & SEI, M. 2020. “Pengaruh Manajemen Laba, Debt Covenant, Current Ratio Dan Total Asset Turnover Terhadap Return Saham”. Doctoral Dissertation, Iain Surakarta.

Ate, A. B. A. t.th.“Pengaruh Rasio Likuiditas, Solvabilitas, Aktivitas Dan Profitabilitas Terhadap Return Saham Pada Perusahaan Yang Terdaftar Di Index Lq-45” Skripsi.

Baron, D.P. 1982. A Model of The Demand for Investment Bank Advising and Distribution Services for New Issues. Journal of Finance 37. p 955-976

Basri, A. I., & UPY, P. M. 2017. “Earnings Management Dalam Initial Public Offering (IPO) Pada Perusahaan Dalam Daftar Efek Syari’ah”. Universitas PGRI Yogyakarta.

Brigham, F Eugene dan Joel, F. Houston. 2013. Dasar-dasar Manajemen Keuangan Buku 1. Edisi Kesebelas. Jakarta Salemba Empat.

Darpius, D., Agustin, H., & Sari, V. F. 2019. “Pengaruh Financial Leverage, Profitabilitas Dan Besaran Penawaran Saham Terhadap Initial Return”. Jurnal Eksplorasi Akuntansi.

Erlina, I. P., & Widyarti, E. T. 2013. Analisis Pengaruh Current Ratio, Eps, Roa, Der, Dan Size Terhadap Initial Return Perusahaan Yang Melakukan Ipo (Studi kasus pada Perusahaan Go Public Yang Terdaftar di BEI Periode 2008-2011). Doctoral dissertation, Fakultas Ekonomika dan Bisnis.

Gautama, A., Diayudha, L., & Puspitasari, V. A. 2015. Analisa Faktor-Faktor Yang Mempengaruhi Initial Return Setelah Initial Public Offering (IPO). Jurnal Administrasi Kantor, 3(2), 539-550.

Ghozali, I. (2018). Aplikasi Analisis Multivariate dengan program IBM SPSS 25 (Edisi 9). Badan Penerbit UNDIP: Semarang.

Jensen, M., C., dan W. Meckling, 1976. “Theory of the firm: Managerial behavior, agency cost and ownership structure”, Journal of Finance Economic 3:305- 360, di-download dari http://www.nhh.no/for/courses/spring/eco420/jensenmeckling-76.pdf.

Downloads

Published

Issue

Section

License

Please find the rights and licenses in Jurnal Kajian Akuntansi dan Auditing (JKAA). By submitting the article/manuscript of the article, the author(s) agree with this policy. No specific document sign-off is required.

1. License

The non-commercial use of the article will be governed by the Creative Commons Attribution license as currently displayed on Creative Commons Attribution-NonCommercial 4.0 International License.

2. Author(s)' Warranties

The author warrants that the article is original, written by stated author(s), has not been published before, contains no unlawful statements, does not infringe the rights of others, is subject to copyright that is vested exclusively in the author and free of any third party rights, and that any necessary written permissions to quote from other sources have been obtained by the author(s).

3. User/Public Rights

JKAA's spirit is to disseminate articles published are as free as possible. Under the Creative Commons Attribution-NonCommercial 4.0 International License, JKAA permits users to copy, distribute, display, and perform the work for non-commercial purposes only. Users will also need to attribute authors and JKAA on distributing works in the journal and other media of publications. Unless otherwise stated, the authors are public entities as soon as their articles got published.

4. Copyrights Holder

With the receipt of the article by Editorial Board of the Jurnal Kajian Akutansi dan Auditing (JKAA) and it was decided to be published, then the copyright regarding the article will be diverted to Jurnal Kajian Akutansi dan Auditing (JKAA).

Jurnal Kajian Akutansi dan Auditing (JKAA) hold the copyright regarding all the published articles and has the right to multiply and distribute the article under